How to Get Rhinoplasty Covered by Insurance?

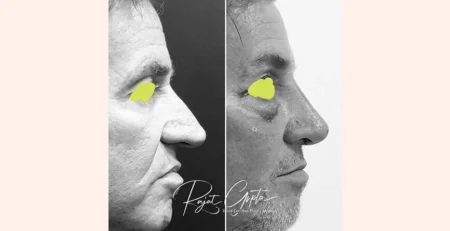

Rhinoplasty, sometimes called a “nose job,” is a surgical treatment designed to change the nose’s form, size, or function.

While many people get rhinoplasty surgery for cosmetic reasons, some need surgery for medical reasons, including correcting breathing problems or resolving structural concerns caused by injuries or congenital diseases. While having a sculpted nose is a frequent aesthetic need, insurance companies rarely pay for operations performed exclusively for aesthetic reasons. However, if your rhinoplasty is considered medically essential, your insurance may provide some financial assistance.

In this blog, we will understand how to get rhinoplasty covered by insurance.

Conditions that Might Qualify for Coverage

Several conditions can make nose job surgery medically necessary that might get covered by rhinoplasty:

- Deviated Septum: It is a misalignment of the cartilage and bone that separates your nostrils, resulting in breathing difficulties, frequent nosebleeds, and facial discomfort.

- Nasal Valve Collapse: This happens when the small channels within your nose get closed, preventing airflow.

- Rhinoplasty Revision: If a previous nose job caused functional concerns, such as breathing difficulties, revision surgery to address these issues may be reimbursed.

- Facial Trauma: Injuries that create a nasal blockage or breathing issues may qualify for insurance reimbursement for rhinoplasty.

Have questions or want to get started? We are ready to help you with a smile!

Steps to Get Rhinoplasty Covered By Insurance

If you believe your rhinoplasty falls under medical necessity, here are the steps to increase your chances of insurance coverage:

Schedule Your Consultation with Specialists: Contact an ENT (Ear, Nose, and Throat) specialist or a board-certified plastic surgeon in India. These specialists will evaluate your condition to decide whether a functional rhinoplasty is medically essential.

Gather Medical Documents: Collect medical documents that detail your breathing concerns. This could include X-rays, CT scans, sleep studies, and a documented history of related issues demonstrating a medical requirement for rhinoplasty surgery.

Seek a Pre-surgical Authorization: Get pre-authorization from your insurance provider before scheduling rhinoplasty surgery. Submit the treatment plan and supporting paperwork to your insurance provider for evaluation. This process helps you calculate how much your insurance will cover upfront and avoids unexpected denials after the surgery.

Understand Your Policy: Understand your insurance policy’s coverage for rhinoplasty. Some insurance policies may have exclusions or limits for cosmetic treatments, but others may cover medically required surgery. Knowing your policy’s terms can help you handle the process more efficiently.

Appeal a Denial (if necessary): Don’t be disappointed if your insurance rejects coverage. Examine the refusal letter and determine the reasons. Consult with your surgeon about providing more paperwork or explanations to support your appeal.

Even with functional rhinoplasty surgery, insurance may not pay the whole cost. Prepare for probable out-of-pocket expenditures such as surgery fees, anesthesia, facility charges, and prescriptions. Insurance coverage for rhinoplasty can be complicated. Understanding the standards, compiling relevant paperwork, and collaborating with your surgeon can improve your chances of a successful claim.

Dr. Rajat Gupta

MBBS, MS, DNB(Gen. Surg.),

DNB (Plastic Surgery)

Dr. Rajat Gupta is a board certified plastic surgeon in India with 13 years of experience to back his expertise in the domain of aesthetic surgeries.

Having completed his training from Maulana Azad Medical College and equipped with a thorough understanding of aesthetic needs of people, Dr. Gupta strives to offer the best remedies and cosmetic procedures outfitted with the latest technology to the aspirants in India and across the globe. To book an appointment, call: +91-9251711711 or email: contact@drrajatgupta.com